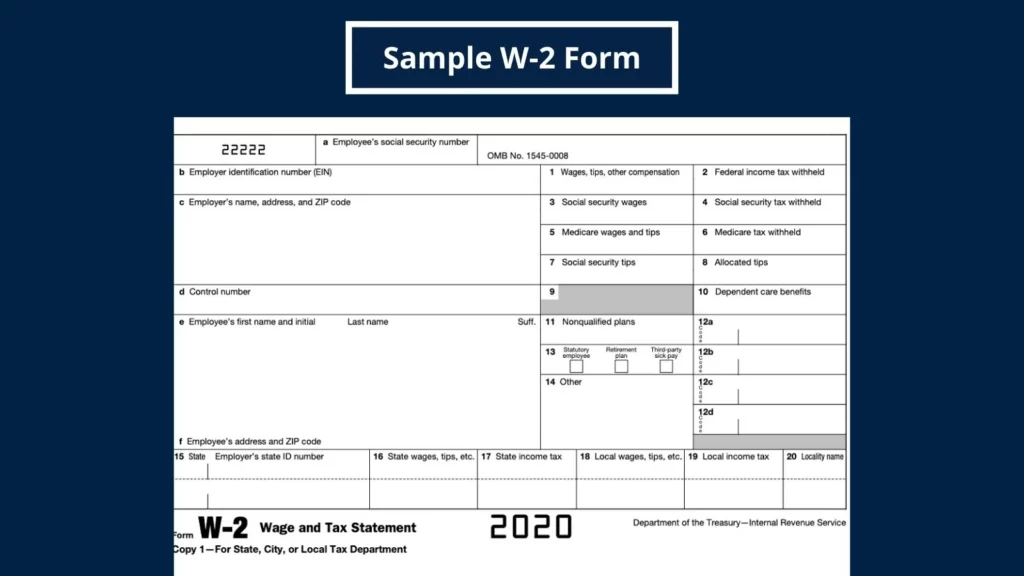

As an employee, one of the most critical documents you’ll receive regarding your employment is the W-2 form. This form is an essential component of your tax filings as it provides a summary of your annual earnings and the taxes withheld by your employer.

The information on the W-2 is crucial for accurately reporting to the Internal Revenue Service (IRS) your income taxes, Social Security, and Medicare taxes.

It also helps you understand how much tax you’ve already paid throughout the year and determines whether you’re entitled to a tax refund or owe additional taxes.

Step-by-Step Guide to Access Your United Airlines W-2 Form Online

For United Airlines employees, obtaining your W-2 is a straightforward process that can be done through the company’s intranet. Here’s a detailed guide:

- Initial Login: Start by visiting the Flying.Together UAL Intranet site. Enter your credentials to log in securely.

- Navigation: Once logged in, navigate to the ‘Employee Services’ tab, which will lead you to various employee resources.

- Accessing Personal Information: Click on ‘My Info’ to proceed to your personal information and payroll data.

- Finding Tax Documents: Select ‘Continue to My Info and Manager’s Toolbox’, which will direct you to a section where you can find tax-related documents.

- Locating Your W-2: Look for the W-2 icon and click on it to access your W-2 statements.

- Downloading Your W-2: Click on ‘Access Current Year-End Statements’, select your W-2 form, and choose ‘DOWNLOAD (PDF)’ to get a digital copy of your form.

- Completing the Process: Follow the prompts to ‘Review and Complete Order’, then ‘Submit Order’, and finally, click on ‘View or Download’ to retrieve your document.

- Printing Your W-2: If you need a physical copy, you can print the electronic W-2 once it’s downloaded.

Before You Begin: Ensure that Adobe Reader is installed on your computer to view the PDF file.

Also, temporarily disable any pop-up blockers to avoid interruptions during the download process. For the best experience, use one of the recommended browsers: Internet Explorer, Firefox, Chrome, or Safari for Mac users.

Receiving Your W-2 by Mail

United Airlines dispatches W-2s to employees each January.

By federal law, they must be sent by January 31st.

If you haven’t received yours, verify your address on file with United Airlines. If it’s incorrect, or if you haven’t received your W-2 by February, contact United Airlines HR for a reissue.

Still no W-2 by late February? Call the IRS at 1-800-829-1040.

Be ready to provide your details, United Airlines information, employment dates, and an estimate of your wages, which can be found on your final paystub of the year.

Conclusion: The Significance of Timely W-2 Access

Accessing your W-2 form on time is crucial for completing your tax returns accurately and efficiently. It helps you reconcile your earnings and taxes withheld, ensuring that you pay the correct amount of taxes or receive the appropriate refund.

For United Airlines employees, the company has streamlined the process to access these forms online, demonstrating a commitment to employee convenience and the importance of adhering to tax filing requirements.

If you encounter any issues or delays, remember that United Airlines HR and the IRS are available to assist you in ensuring you have the necessary documentation for your tax obligations.